|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

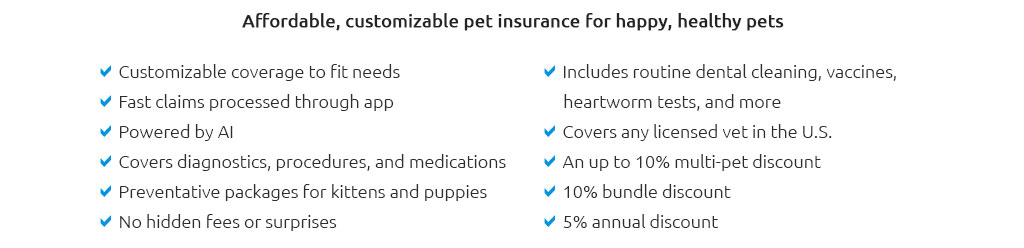

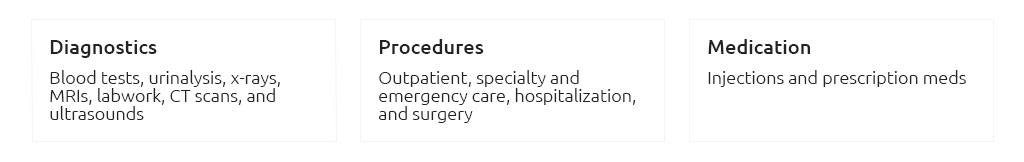

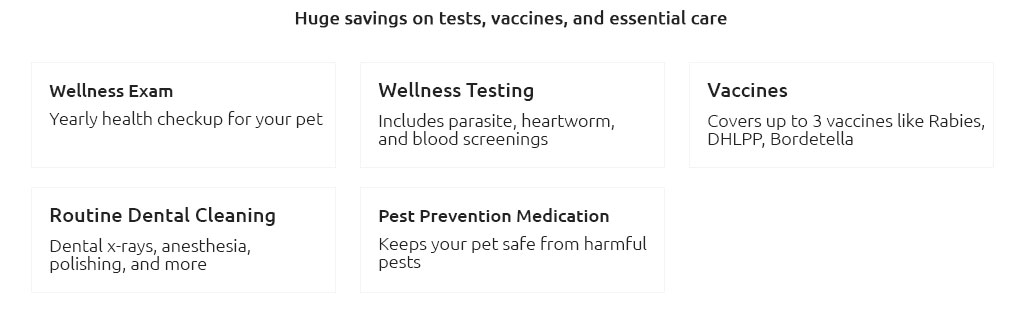

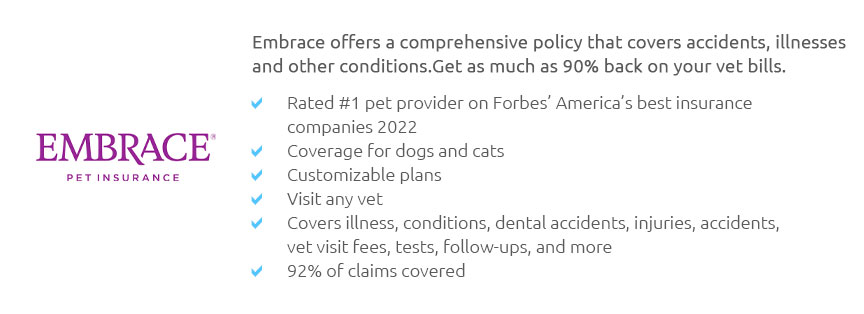

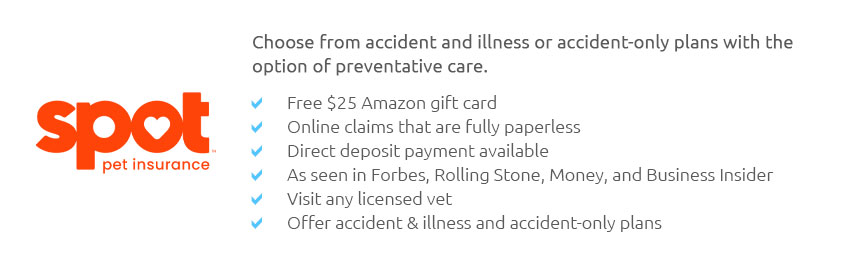

Exploring the Realm of Multi-Pet Insurance OffersFor pet owners, the love and joy that animals bring into our lives is immeasurable, yet the responsibility of caring for their health and well-being often requires careful financial planning. As more households welcome multiple pets, the concept of multi-pet insurance offers has gained traction, providing a safety net that can be both economical and comprehensive. The idea is simple: insuring more than one pet under a single policy can often result in significant savings and streamlined management, a win-win scenario for both the pet owner and the insurance provider. Multi-pet insurance offers generally work by providing a discount on the premium when additional pets are added to a single policy. These offers can vary widely among different insurance companies, with discounts typically ranging from 5% to 10% per additional pet, though some insurers might offer even more attractive rates. One of the primary benefits of multi-pet insurance is the convenience of managing one policy with one renewal date, reducing the administrative hassle of dealing with separate policies for each pet. Moreover, it ensures that all your pets are covered under the same terms and conditions, which simplifies the decision-making process when selecting coverage options. However, like any insurance product, there are nuances that require careful consideration. Not all insurance providers offer multi-pet discounts, and among those that do, the specifics of coverage can differ significantly. It is crucial to examine the fine print, assessing factors such as the types of coverage available, any exclusions or limitations, and the reimbursement rates. Some policies might offer coverage for accidents and illnesses but exclude routine care, while others could provide a more comprehensive package that includes wellness visits, vaccinations, and even dental care. Therefore, conducting thorough research and comparing policies from different providers is a prudent approach to ensure that you secure the best deal that meets your pets' needs. In terms of best practices, it is advisable to evaluate your pets' specific health needs and risk factors, such as breed-specific conditions or age-related issues, as these can influence the type of coverage that would be most beneficial. Consulting with your veterinarian can provide valuable insights into potential health issues that might arise, allowing you to tailor your insurance policy accordingly. Additionally, consider the financial aspects: while a higher deductible might reduce the premium, it could also mean higher out-of-pocket expenses in the event of a claim. Balancing these elements is key to finding an optimal insurance solution. Another aspect worth considering is the customer service and claims process of the insurance provider. Efficient and supportive customer service can greatly enhance your experience, particularly when dealing with the stress of a pet's illness or accident. Reading reviews and seeking recommendations from fellow pet owners can be an excellent way to gauge the reliability and responsiveness of a provider. Ultimately, multi-pet insurance is a wise investment for pet owners seeking peace of mind and financial protection. By carefully evaluating the available options and tailoring a policy to fit the unique needs of your furry family members, you can enjoy the companionship of your pets with the assurance that their health is safeguarded. Frequently Asked QuestionsHow does multi-pet insurance differ from single-pet insurance? Multi-pet insurance allows you to cover multiple pets under one policy, often at a discounted rate, whereas single-pet insurance covers only one animal per policy. Are there any limitations to multi-pet insurance? Yes, limitations can include exclusions for pre-existing conditions, specific breed-related issues, or age limits, so it's important to read the policy details carefully. Can I add a new pet to an existing multi-pet policy? Most insurers allow you to add new pets to an existing policy, often with an adjusted premium that reflects the addition. What factors should I consider when choosing a multi-pet insurance provider? Consider factors such as coverage options, customer service reputation, claims process, and the total cost including premiums and deductibles. https://figopetinsurance.com/blog/benefits-pet-insurance-multiple-pets

Most insurance plans offer multi-pet plans. Under this type of plan, each pet will typically have a separate policy, but you'll be able to manage them from one ... https://www.moneygeek.com/insurance/pet/best-pet-insurance-more-than-one-pet/

In addition to the 10% discount it offers for enrolling multiple pets, you can also reimburse up to 90% of your veterinary costs. The Best Pet Insurance for ... https://www.pumpkin.care/blog/pet-insurance-for-multiple-pets/

We're explaining how to get pet insurance for multiple pets, what pet insurance plans cover, and why getting coverage is so important.

|